Income Ladder

The Blue Water Income Ladder is simply a ladder of cash, CD’s, individual bonds and target maturity bond funds. It is both an enhanced-income strategy and a defensive strategy. We use this strategy for retirees, those nearing retirement and people who seek more stability within their bond holdings.

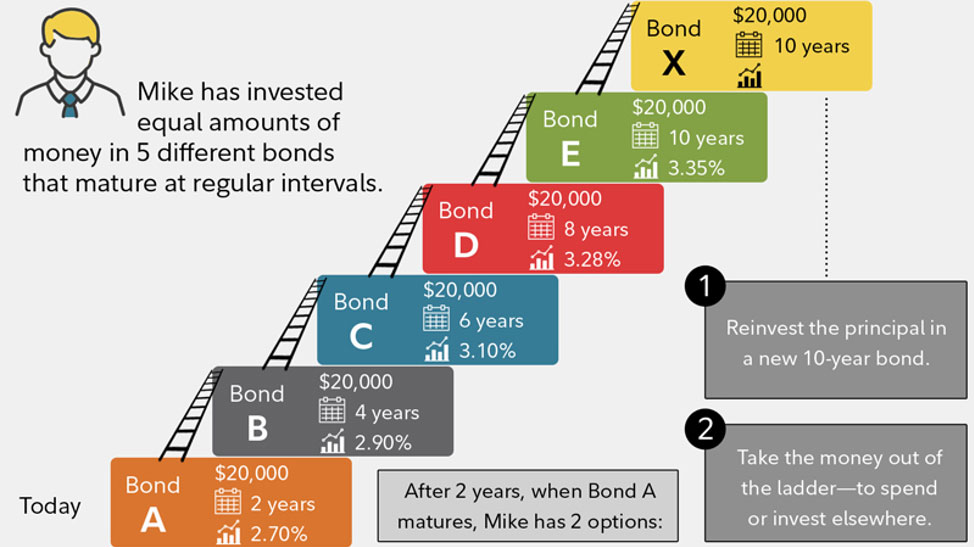

Here is a conceptual illustration of an Income Ladder (courtesy of Fidelity). Basically, it is a set amount of money maturing at various dates in the future.

The above is a simplified example of an Income Ladder. It does get a little more complex. For example, most people do not have the same amount of money maturing each time. Retirees may need more money one year for a large vacation or car purchase. Or there might be several years of larger withdrawals as they bridge the gap until social security or Medicare begins.

We try to be as efficient as possible when designing our Income Ladder. For retirees, we normally keep a little over 3 months of their withdrawal needs in money market, and then use 3-month, 6-month and 9-month CDs for the rest of the withdrawal needs for the year. It’s a balance of maximizing yield and making sure we have ample cash for monthly withdrawals. It is similar to the “Just-In-Time” manufacturing method, but instead of raw materials arriving right when a manufacturer needs them, the Income Ladder keeps cash working for you (earning higher interest) until right before you need it.

For year 2, we typically use 12-month and 18-month CDs. For years 3+ we primarily just use individual bonds, target maturity bond funds and 4-7 year fixed rate annuities. These investments hold the expected withdrawal needs for the coming year. When they mature, we then repeat the process of the first year (keep some in cash and buy 3, 6 and 9-month CDs).

The Income Ladder is not a separate account or portfolio. It is built out of a portion of the bond side of the portfolio.

Benefits of an Income Ladder

There are several benefits to building an Income Ladder into a portfolio.

- Smooth and predictable income: If someone’s withdrawal needs are $5,000/month (and that is a sustainable amount), then that’s what they receive. A person’s withdrawals are not affected by the ups and downs of the market or the unevenness of dividend and interest payments. People like to know what they are going to get. This approach gives them that comfort. Some people like to think of it as a paycheck replacement.

- Insulates withdrawals from market volatility: Since a person’s withdrawal needs are separated from the longer-term investment portfolio, there is no need to sell investments that have temporarily dropped in value. Most Income Ladders are 3-6 years long, so it would take a very prolonged bear market to exhaust the protection this strategy provides. Even then, since the Income Ladder is usually only a portion of the bond side, there would still be other bond investments that could be sold before switching to stocks. These bond investments would likely fare a lot better than stocks, and essentially, prolong the portfolio’s protection in worst-case scenarios.

- Protects portfolio from untimely cash needs: We prefer people to have an emergency fund outside of their investment portfolio, but we understand emergencies happen. If the stock market is down, it’s best to tap into regular bond investments or the back-side of the Income Ladder before selling stocks for cash needs.

- Opportunistically replenish cash and rebalance the portfolio: If the stock market is up, it could be a good time to take some gains off the table. Proceeds can be used to rebalance the portfolio and add to the back-end of the Income Ladder, thus extending out the protection longer.

- Provides tax flexibility: It is important to still use proper tax management with the Income Ladder. That includes:

- only providing the income that’s needed

- taking withdrawals from multiple accounts in order to manage a person’s tax situation

- tax-loss harvesting in taxable accounts (selling a fund that has a loss and buying a similar fund)

- withholding adequate taxes so there’s not a huge tax surprise the following year

- Adaptable to personal preferences: An Income Ladder is not a “one size fits all” strategy. Some people prefer a shorter ladder while others feel more comfortable with more protection from a longer one. Some people know exactly what their withdrawal needs will be and want very little excess in their ladder. Others are unsure and prefer to build in some excess cash and maturities. An example of this may be if a person thinks they’ll need $75,000/year for the next couple of years, but really isn’t sure. Instead of making them commit to a fuzzy number, it’s better to build in some extra cash (maybe $60,000). If the excess cash isn’t needed, then it gets added to another part of the Income Ladder.

It’s easy to see how a retiree would benefit from an Income Ladder, but those near retirement can benefit as well. They may not need an immediate ladder (cash, 3-month CDs, etc.) but one can be built to coincide with an expected retirement date. If they are 2 years away from retirement, then perhaps a ladder is built with maturities of 2-7 years.

Finally, the Income Ladder can be used as more of a defensive strategy. A ladder of CD’s, individual bonds and target maturity bond funds could be used instead of traditional bond funds for those who seek more stability. Values would still fluctuate, but investors may sleep easier knowing that if these investments are held to maturity, they have a better idea of their proceeds.